do nonprofits pay taxes on donations

However here are some factors to consider when. RAB 2016-18 Sales and Use Tax in the Construction Industry.

How To Write A Donor Acknowledgement Letter Altruic Advisors

If you deduct at least 500 worth of noncash donations.

. Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Your recognition as a 501 c 3 organization exempts you from federal income tax.

The underlying items are taxable or not based on existing state law whether the non-profit vendor is obligated to collect or not. But nonprofits still have to pay. Yes nonprofits must pay federal and state payroll taxes.

The IRS considers charitable donations as any donation or gift made to a qualified nonprofit. Most nonprofits do not have to pay federal or state income taxes. Other important sources of.

First and foremost they arent required to pay federal income taxes. Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations. Fill out Form 8283 if youll deduct at least 500 in donated items.

What Does a Nonprofit Do. Most nonprofits fall into this category and enjoy numerous tax benefits. Do You Pay Tax On Shipping.

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. Charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

They must pay business and occupation BO tax on gross revenues generated from regular business. For merchandise Tangible Personal Property TPP rules apply. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax.

Additionally you must attach an appraisal of your items to the form if. What Are Charitable Donations. We want to help you get the information.

Do 501c3 pay taxes on donations. Do nonprofit organizations have to pay taxes. Fundraising Sources for Nonprofits.

Individual donations are the top source of income for nonprofits making up 70 percent of all giving in 2017. In most cases they wont owe income taxes at the. We recognize that understanding tax issues related to your organization can be time-consuming and complicated.

Form 3520 Michigan Sales and Use Tax Contractor Eligibility. There are more than 25 types of. Nonprofits that qualify for 501c3.

Sadie is ready to get up to speed on paying payroll taxes. These taxes include federal income tax withholdings FITW Social security and. In Washington nonprofit organizations are generally taxed like any other business.

Persons who donate goods to nonprofit charitable organizations or state or local government entities are exempt from use tax if they have had no intervening use of the goods. Many but not all nonprofits are considered tax exempt which means that they are not required to pay federal corporate.

Accepting Cryptocurrency Donations In 2022 Complete Guide For Nonprofits

Pga Tour Tax Breaks Help Fuel Giving Which Still Falls Below Industry Standards

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Tax Benefits Of Corporate Matching Gifts The Basics

The Nonprofit Guide To Facebook Donation Tax Receipts

2022 Car Donation Tax Deduction Information

Can Nonprofits Sell Products Or Services Legally Spz Legal

Illinois Nonprofit Lawyer 501 C 3 Vs 501 C 4 James C Provenza

Complete Guide To Donation Receipts For Nonprofits

Tax Advantages For Donor Advised Funds Nptrust

Do Nonprofit Organizations Need To Pay Taxes Boardeffect

5 Nonprofit Fundraising Laws You Should Know About

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

How To Pay Your Nonprofit Staff

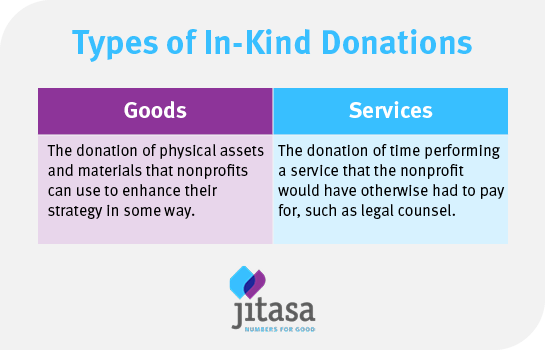

In Kind Donations Everything Your Nonprofit Should Know

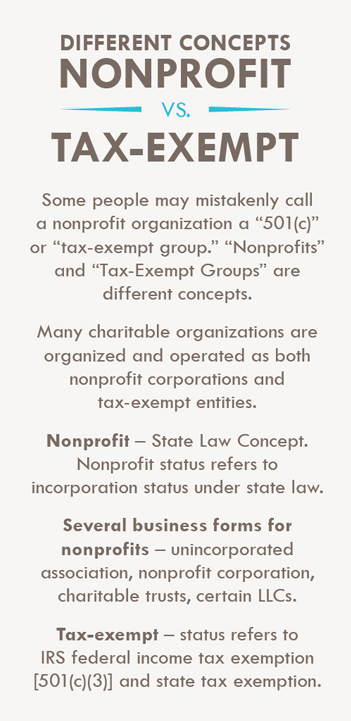

What Is The Difference Between Nonprofit And Tax Exempt

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)