utah state food tax

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Both food and food ingredients will be taxed at a reduced rate of 175.

The Best Food In Utah Best Food In America By State Food Network Food Network

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

. In the state of Utah the foods are subject to local taxes. The state currently earns close to 149 million. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Grocery food does not include alcoholic. File electronically using Taxpayer Access Point at.

Tobacco Cigarette Taxes Motor Vehicle Taxes Fees Property Taxes Note regarding online filing and paying. UTAHS FOOD TAX The repeal of the states 175 food tax emerged as an issue in the 2022 session pushed by Lesser and the candidates sounded off on the topic. Its a regressive tax that unfairly impacts the economically poor.

Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a. State Local Option Mass Transit Rural Hospital Arts Zoo. Restaurants that sell grocery food in addition to prepared food may collect.

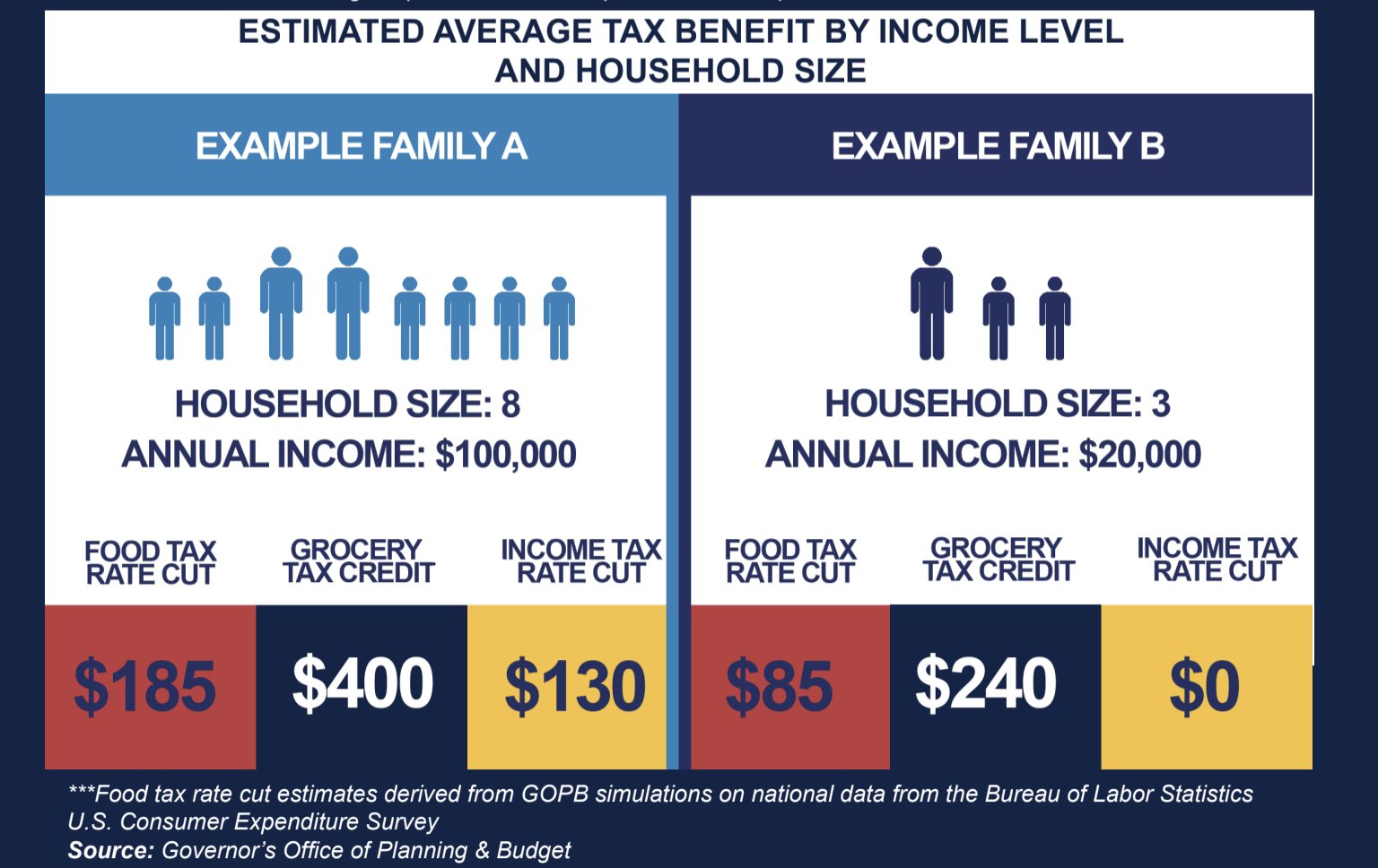

Its a proposal that has not found traction within the republican-controlled utah legislature and its leadership which this year prefers an across-the-board 160 million income. Cities and counties in Utah are allowed to levy their own local sales taxes on grocery food and my bill would not change that. However in a bundled transaction which.

To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. For security reasons our e-services are not available in most countries.

She also learned this statistic from the US. Tax rates are also available online at Utah Sales Use Tax Rates or you can. Low-income families spend 36 of their income on food compared to 8 for high-income families.

The first is sponsored by. Both food and food ingredients will be taxed at a reduced rate of 175. In-State Per-Diem Rates - Utah Division of Finance In-State Per-Diem Rates Lodging Per Diem Rates Unless listed below the lodging per diem rate for a Utah city is 7000 plus tax.

After a few seconds you will be provided with a full breakdown of the. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. Taxing grocery store food unfairly places the burden on the most vulnerable.

There are currently two stalled bills in the 2022 General Session of the Utah Legislature with the aim of ending the 175 state sales tax on food. In the state of Utah the foods are subject to local taxes. Pritzkers Family Relief Plan also includes several tax holidays and rebates including a suspension of the states sales tax on groceries from July 1.

However in a bundled transaction which. SALT LAKE CITY ABC4 News The Utah State Legislature Tax Restructuring and Equalization Tax Force is expected to make a decision Monday evening on whether a proposal. Utah just passed a tax reform bill that raised the.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum. The tax on grocery food is 3 percent.

Cutting That Bagel Will Cost You Weird State Tax Laws

These Are Some Of The Most Popular Foods In Utah

State Sales Tax Rates Tax Policy Center

Utah Gov Spencer J Cox On Twitter Our Recommendations Include A 160 Million Tax Cut In The Form Of A Grocery Tax Credit Some Have Proposed Eliminating The State Sales Tax On

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Business Guide To Sales Tax In Utah

How Are Groceries Candy And Soda Taxed In Your State

2 3 Of Utahns Oppose Reinstating Sales Tax On Food But They Re Unsure About Imposing Sales Taxes On Services Utah Policy

Snap Guidance Illinois Has Suspended Grocery Tax For A Year But Some Items Not Covered Gobankingrates

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Call To Action To End Utah S Food Sales Tax

Utah Gop Democratic Lawmakers Will Join To Try Scrapping State Food Tax Kutv

Voices For Utah Children Utah Tax Reform Proposals Who Wins And Who Loses

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Opponents Of Proposed Food Sales Tax Increase Say Low Income Families Will Suffer

The Missing Narrative Of Sb 2001 By Cindy Wilmshurst Inquiry Of The Public Sort

Will Utah Repeal Its State Sales Tax On Food Deseret News

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities